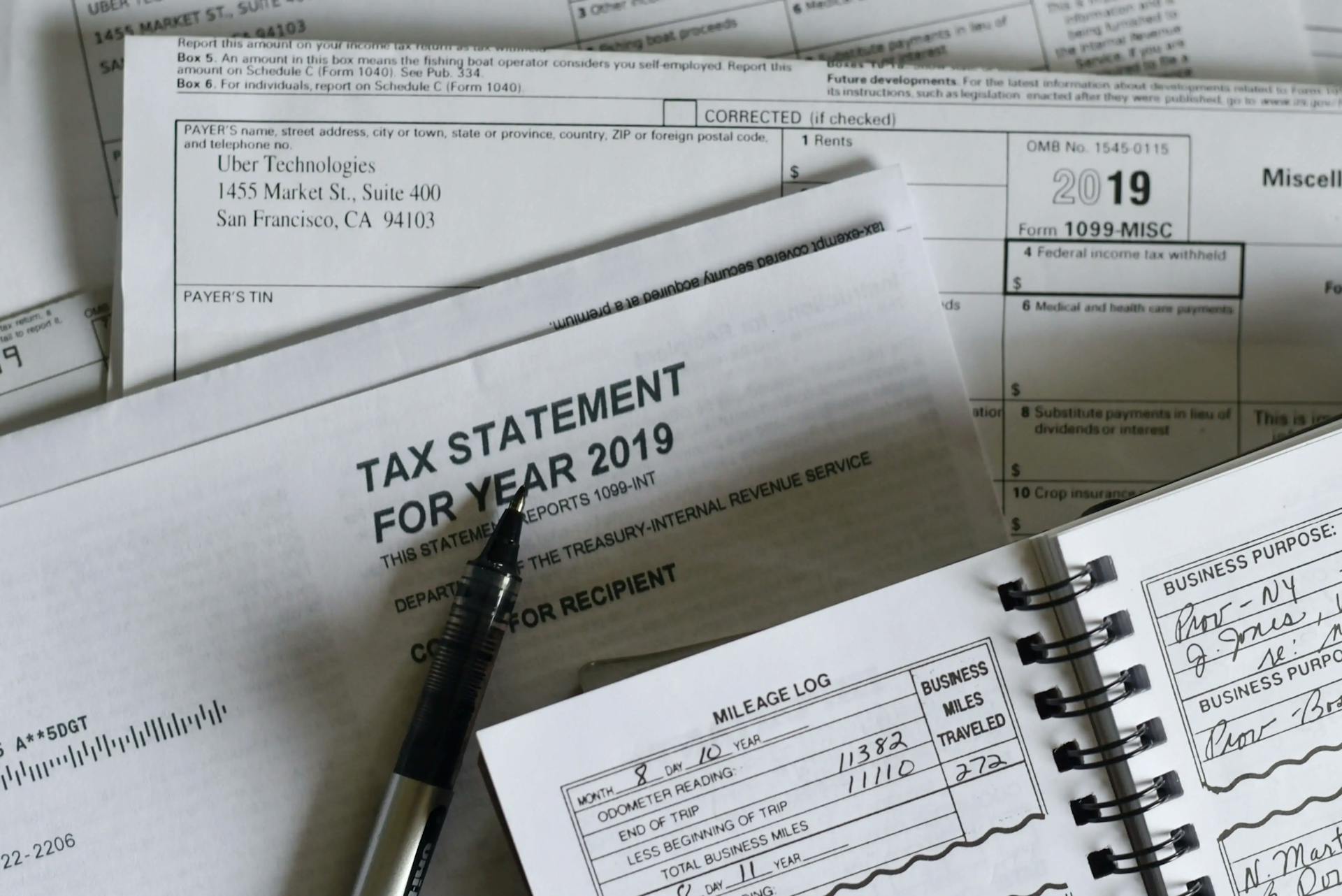

Tax Services

Panic when receiving CRA mails? When you receive a notice of reassessment from the Canada Revenue Agency (CRA), the potential for major financial consequences arises. The CRA may recommend seeking assistance from a qualified specialist. These experts are well-versed in current tax laws. Our team belongs to this skilled group, capable of closely partnering with you, engaging directly with the CRA, and creating a targeted tax strategy to alleviate any tax-related difficulties you may be facing.

- Corporate tax return

- Personal income tax return

- Catch-up Service, late filing tax return (both corporation and individual)

- Self-employed tax return

- T-slips:T4/T5/T5018… and summary

- Business proposals for small business loan

- HST new housing rebate

- Bank freeze and payment plan with CRA